what nanny taxes do i pay

You can then pay the IRS. You need BOTH of these conditions to be true.

Do I Have To Pay Nanny Tax On A Babysitter

The Nanny Tax Company has moved.

. If your nanny is a W-2 employee you must withhold taxes. You will use this form to file your. Simply divide your nannys total annual salary by 12.

What are these taxes. The difference lies in the way you pay your nanny and how he or she claims the income on his or her income taxes. According to IRS Publication 926 youre exempt from.

Unless you pay state unemployment insurance the Federal Unemployment Levy Act FUTA tax is 6 of your employees salary see below. In that case youll need to withhold and pay Social Security and Medicare taxes which are 153 of the employees wages. The taxes that need to be paid on the 1000 would be 133.

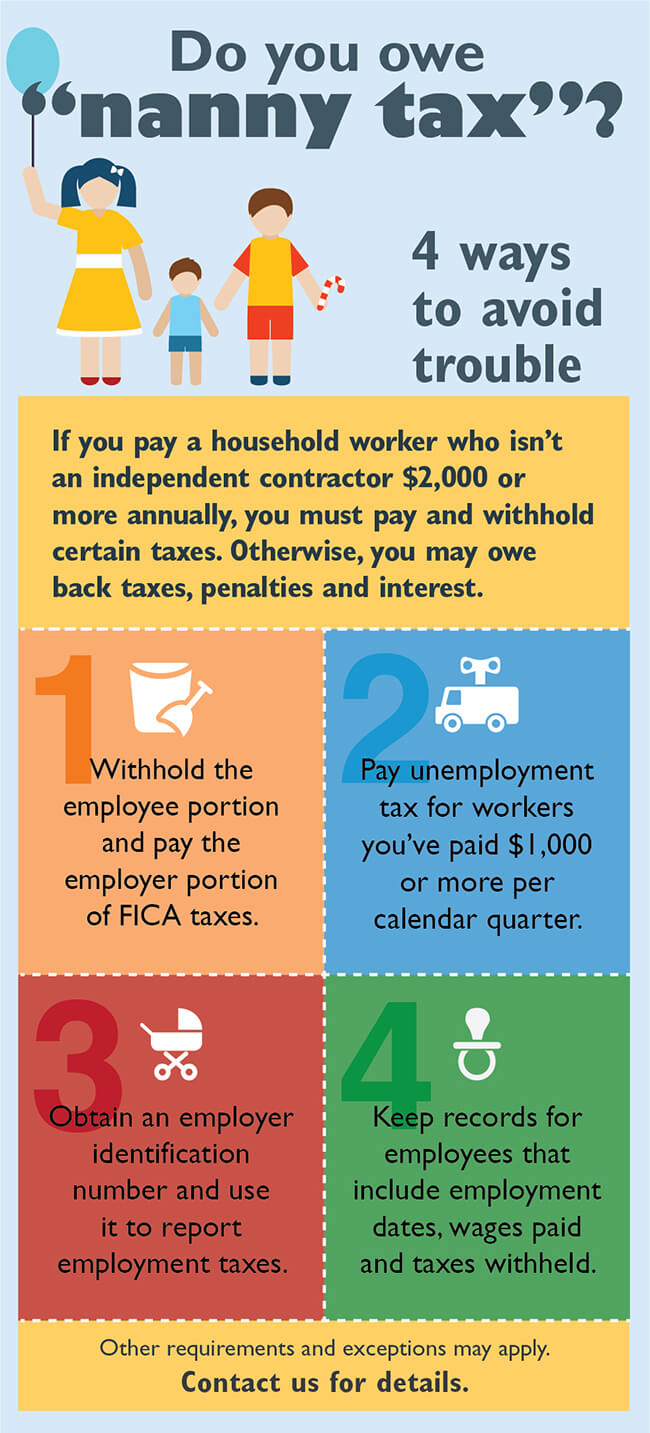

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. I am a nanny how do I pay my taxes.

How much tax do I pay as a nanny. You need both federal and state tax identification numbers to report and pay your nanny taxes. This form will show your wages and any taxes withheld.

For the 2022 tax year nanny taxes come into play when a family pays any household employee 2400 or more in a calendar year or 1000 or more in a calendar quarter for unemployment insurance taxes. You get your federal employer identification number FEIN from the IRS. Your obligations will vary depending on where you live.

This will equal the nannys gross monthly wages before federal and state taxes are withheld. You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare. The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount.

If you have a nanny or any household employee who makes more than 2300 in a calendar year you have to pay a combination of state and federal taxes. As a general guide you can expect to pay in the low-20s per hour for less experienced care and in. The 2022 nanny tax threshold is 2400 which means if a.

Register as an employer. Your employer is required to give you a form W2 by January 31st. Nannies will typically cost 25-30 per hour.

Nanny Taxes and How to Pay Them. If you paid a total of more than 1000. Now that weve covered what the nanny tax is youre probably wondering if its something you actually have to pay.

You the employer pay 765 percent or 7650 and the rest 5650 is withheld from the nannies wages. If your nannys salary is 42000. If youre planning to pay your nanny more than 2200 year or an average of at least 183 per month you need to pay taxes.

Additional requirements may apply for individual employees whom you pay more than 200000 in wages. Top 3 Reasons to pay nanny taxes are that its the right thing to do you can save money by paying nanny taxes and if you dont the IRS will catch you. Calculate social security and Medicare taxes.

If your nanny is a W-2 employee.

How To Do Your Nanny Taxes The Right Way Marin Mommies

Years After Scandal Millions Continue To Avoid Nanny Tax Wsj

Everybody Has To Pay Taxes Parental Choice Ltd By Parental Choice Issuu

You Re Not The Only One Who S Not Paying Your Nanny Tax Wsj

Nanny Pay Taxes Saint Paul Minnesota Tent Group

Paying Your Nanny Legally In Texas The First Milestones

Filing 2020 Nanny Taxes Us Nanny Association

Guide To The Nanny Tax For Babysitters And Employers Turbotax Tax Tips Videos

The Nanny Tax Must Be Paid For More Than Just Nannies O Brien Shortle Reynolds Sabotka Pc

Do You Owe Nanny Tax Yeo And Yeo

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax College Survival Guide

Why Should I Pay Nanny Taxes If My Nanny Is Ok With Being Paid Off The Books Stanford Park Nannies Stanford Park Nannies

Nanny Tax Definition Why And How To Pay Nanny Taxes

Nanny Tax Salary Guide Nanny Lane

More Nanny Taxes What To Do If They Accidentally Give You A 1099 Youtube

How Do Nanny Taxes Work They Re Complicated But Skipping Them Is A Mistake Marketwatch

Nanny Taxes Explained Tl Dr Accounting